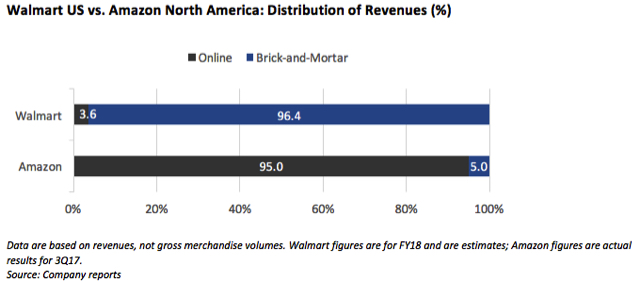

Walmart versus Amazon is perhaps the biggest retail battle of our times—and Amazon’s encroachment into brick-and-mortar grocery retailing with its Whole Foods Market acquisition has only heightened the competition. Coincidentally, both of these retail giants have recently made the unusual move of splitting out numbers for their online versus offline revenues. At Walmart’s annual Investment Community Meeting in October, management noted that it expects the Walmart US segment to see $11.5 billion in online sales in the year ending January 2018. When Amazon reported its third-quarter results in October, management said that the company had booked $1.28 billion in revenue during the quarter from its physical stores—mainly, its Whole Foods stores. From these numbers, we can see that the two companies’ online/offline splits are polar opposites:

Both companies are likely to grow those small percentage shares—brick-and-mortar sales will probably become more important for Amazon, just as online sales will for Walmart. And while much attention has focused on Amazon’s move into physical retail, we have been impressed with how Walmart has performed online over the past year, and note that the company has implemented a series of initiatives and acquisitions that have strengthened its hand in the competition for online dollars.

We provide a full timeline of Walmart’s notable e-commerce developments over the past 15 months at the end of this note. These are a few of the company’s most recent moves:

- Walmart has doubled its number of online grocery pickup locations year over year, to 1,100 as of the end of its fiscal third quarter. The company aims to add another 1,000 locations next year.

- The company is rolling out its automated Pickup Towers to around 500 stores, according to news website Bisnow.

- Walmart has followed Amazon in pushing aggressively into third-party sales, tripling the number of stock-keeping units (SKUs) on its site year over year by the end of the third quarter by building out its marketplace site.

- As part of the build-out of its marketplace, Walmart will host a Lord & Taylor fashion store on its site beginning in 2018.

How Do We See the Battle Shaping Up?

The Walmart-Amazon battle is no longer simply about Walmart taking the fight online to prevent loss of share in nongrocery categories. Since Amazon’s acquisition of Whole Foods, the battle has been about winning across channels and across categories, from food to fashion. We expect to see no letup in innovation from either company—but if Amazon pushes into physical retail more aggressively, Walmart may shift its position from pushing aggressively online to defending its brick-and-mortar core.

Walmart: Recent E-Commerce Developments

| Nov 2017 | Plans to extend automated Pickup Towers to 500 stores |

| Nov 2017 | Announces that Lord & Taylor will launch a flagship store on Walmart.com, likely in the spring of 2018; the site will offer premium fashion brands directly from the Lord & Taylor flagship |

| Nov 2017 | Narrows price gap with Amazon, per a Reuters report citing data from analytics firm Market Track |

| Nov 2017 | Online SKUs number >70 million, triple the number one year earlier |

| Nov 2017 | Grocery Pickup locations number 1,100, with a further 1,000 set to open next year |

| Nov 2017 | Launches same-day grocery delivery in the San Jose area, in partnership with delivery service Deliv |

| Nov 2017 | Daniel Eckert, Walmart’s senior vice president for services and digital acceleration, predicts Walmart Pay, the company’s mobile payments service, will outpace Apple Pay by number of transactions in the 2017 holiday season |

| Oct 2017 | Announces the launch of Mobile Express Return, which allows customers using its smartphone app to return online purchases more easily and quickly in its stores |

| Sep 2017 | Starts testing in-home delivery while customers are away from home, in partnership with August, a smart-home tech firm |

| Jul 2017 | Announces plan to roll out automated Pickup Towers to 100 stores |

| Jun 2017 | Acquires Bonobos for $310 million |

| Jun 2017 | Begins testing delivery of online orders by store staff in their nonwork time |

| Apr 2017 | Launches Pickup Discount, offering reduced prices on selected items for online shoppers who opt to pick up their order instead of getting it delivered |

| Mar 2017 | Acquires ModCloth for $50–$75 million |

| Feb 2017 | Acquires Moosejaw for $51 million |

| Jan 2017 | Acquires ShoeBuy.com for $70 million |

| Aug 2016 | Acquires Jet.com for $3.3 billion |

Source: Company reports

Other pieces you may find interesting include: Amazon Pay Places: Amazon’s Next Conquest Could Be Mobile Payments, Walmart (WMT) Fiscal 3Q18 Results: Beats Estimates, Boosted by Groceries and Online Sales; Raises FY18 EPS Guidance, Takeaways from Walmart’s 2017 Investment Community Meeting: Moving with Speed, Deep Dive: US Consumer Survey—Can Amazon Prime Lure Lower-Income Shoppers Away from Walmart?

Connect with us on social media:

@DebWeinswig

@FungRetailTech

Facebook

LinkedIn

Subscribe to our YouTube channel

Pinterest

Instagram