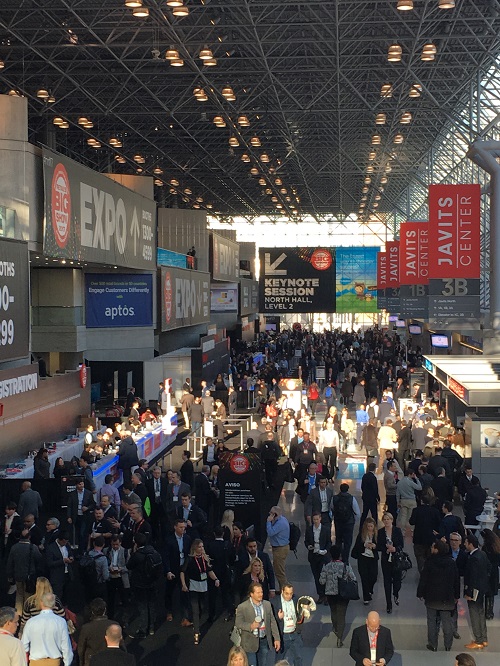

Two events from the past week have led us to reflect on the future of the retail landscape. First, our US

team attended the National Retail Federation (NRF) Retail’s Big Show 2017, where there was much

discussion of the reshaping of retail, including opportunities to improve the customer experience. Second,

US fashion retailer The Limited announced the closure of all 250 of its stores as it moves to online-only

operations, prompting further consideration of the role of the physical store.

In-Store Experience in Retail

At the NRF Retail’s Big Show 2017, we heard a number of speakers and other attendees emphasize the

opportunity to improve the in-store experience, including through the use of new technologies. Few can

doubt that a high-quality, unique in-store experience offers a complement to the functionality of ecommerce.

Better service offerings, more in-store events and improved store environments are all weapons

that brick-and-mortar retailers can wield in the battle against players such as Amazon. And there is

significant potential for some retailers—notably, some of America’s major department-store chains—to

improve their proposition.

Source: Intel and Fung Global Retail & Technology

But we must not get carried away with believing that experience alone will save brick-and-mortar stores. If a

consumer wants cheap electronics, or urgently needs to buy groceries, or simply wants to collect a purchase

she made online, then the store experience may be completely irrelevant to her. Moreover, some retailers

may find it difficult to change their focus to the quality of the in-store experience due to their traditional

positioning.

Convenience, Collection, Destination to Drive Store Traffic

So, experience is not the only opportunity for stores. In our view of the retail future, three core functions

will drive shopper traffic once e-commerce has established a major share:

- Convenience: shoppers will make distress purchases of goods needed quickly, often at stores close to home

- Collection: shoppers will go to a store to pick up online purchases.

- Destination: leisure shoppers will still make trips to those stores that they like to visit rather than have to visit.

Our vision of the future includes a mix of formats, store sizes and retail propositions. Smaller, more local

stores will serve demand for convenience and maybe collection, too; we are already seeing retailers such as

Target open these kinds of stores. Meanwhile, high-quality flagship stores will be the ones that focus on the

customer experience in order to attract leisure shoppers who are looking to spend some enjoyable time

browsing and buying.

Large-store retailers that offer relatively few compelling reasons for shoppers to visit will face the most

difficulty in this retail landscape. These include the hard-hit department stores and other retailers whose

traditional USPs have been breadth of choice or low prices. These kinds of retailers must consider how their

estates will meet shopper needs in the future: this may mean not only fewer stores, but also stores that

cater to how consumers shop in a digital age. By focusing on one or more of the themes of convenience,

collection and destination, such large-store operators may be able to successfully reposition themselves for

the future.

Other pieces you may find interesting include; Top Ten Takeaways from the NRF Day 1, Top Ten Takeaways from the NRF Day 2, Top Ten Takeaways from the NRF Day 3

If you like what you are reading, subscribe to our daily news and analysis of retail, technology and fashion here.

Connect with us on social media:

@DebWeinswig

@FungRetailTech

Facebook

LinkedIn

Subscribe to our YouTube channel

Pinterest

Instagram