The battle for online grocery shoppers is intensifying. Last week, Jet.com appointed Simon Belsham, a veteran of the UK online grocery industry, as President, signaling a further commitment to grocery by Jet and, in turn, a heightening of competition in the fast-developing US online grocery market.

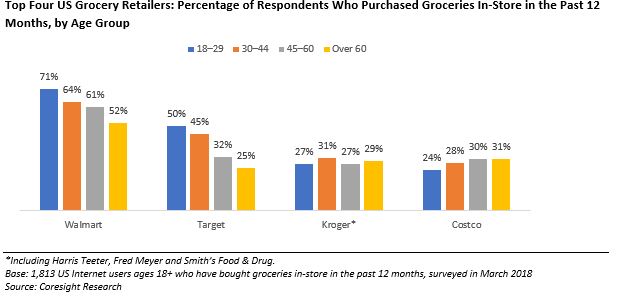

Walmart acquired Jet.com with the aim of tapping a younger consumer segment, as Jet attracts “higher-income, urban, millennial customers,” as Walmart CEO Doug McMillon said recently. However, the stereotype of digitally focused millennials seeking out on-trend pure-play retailers does not accurately reflect the grocery landscape. In fact, younger shoppers flock in disproportionate numbers to Walmart and Target for their groceries. For example, 18–29-year-olds are twice as likely as those over age 60 to buy groceries from Target stores, as shown below.

More broadly, we consider it much more difficult to make pure-play Internet retailing work in the grocery category than in nonfood categories, and Amazon’s recent retreat from Internet-only retailing in grocery reflects this: the company withdrew AmazonFresh from some US regions in late 2017, merged its Prime Now and AmazonFresh operations more recently, and ventured into brick-and-mortar grocery with its acquisition of Whole Foods and launch of the Amazon Go store format.

Together, these data points imply that Target and Walmart, rather than Internet-only retailers such as Jet.com, are likely to make the most impactful moves to cater to young, cross-channel grocery shoppers. And we have already seen a flurry of activity from Target and Walmart:

- Following its December acquisition of Shipt, Target is rolling out same-day delivery for a number of categories, including groceries, across its store portfolio. Last year, Target launched its Restock service, which allows customers to fill a box with essentials for next-day delivery.

- Target also made two significant hires in 2017 as part of its effort to strengthen its grocery offering: the company hired Mark Kenny as VP Divisional, Meat and Fresh Prepared Food, and Liz Nordlie as VP, Product Design and Development, Food and Beverage.

- In September last year, Walmart bought startup Parcel, a technology-based, last-mile delivery service that specializes in the delivery of perishable and nonperishable items to customers in New York City.

- In March, Walmart announced that it plans to expand grocery home delivery from six markets to 100 by the end of 2018, using partnerships with firms such as Uber. Walmart will also add grocery pickup services to 1,000 more stores this year.

Amazon is often lauded as the greatest innovator in retail, but in the grocery category, it is playing catch-up, and adapting as it recognizes it needs brick-and-mortar stores to fully compete in the category. Grocery is uniquely multichannel, and we expect multichannel retailers to continue to dominate, including among much-sought-after millennial consumers.

Other pieces you may find interesting include: Kohl’s and Aldi: A Win-Win for an Overspaced Department Store and a High-Growth Grocery Chain, Deep Dive: Private Label in US Grocery—Five Drivers of Growth

@DebWeinswig

@FungRetailTech

Facebook

LinkedIn

Subscribe to our YouTube channel

Pinterest

Instagram