We are being hit with a deluge of negative headlines about US retailers—in this publication and elsewhere—which would lead the reader to believe that retail is on the brink of extinction. This is not the case. Although many retailers are currently suffering from negative same-store sales, leading them to close stores, they remain—at least at present—largely profitable. And although the continuing and growing encroachment by e-commerce remains a serious threat, let us counter the hysteria with a few facts.

- US retail sales are fairly healthy, but some have been postponed by tax-refund delays. US retail sales (excluding food services and automobile parts) in 2016 grew by a solid 2.6%, which was one full percentage point faster than GDP growth last year. Retail sales have been somewhat anemic thus far in 2017, growing by 0.1% in February on the heels of 0.6% growth in January. Sales have been weaker at electronics and appliances stores, apparel outlets and car dealers, which could have been caused by a temporary delay in the processing of income tax refunds this year. Economists expect the data to show that spending picked up in March, though, as more tax filers received their refunds.

- E-commerce still accounts for less than 10% of quarterly retail sales in the US. In its fourth-quarter 2016 report, the US Census Bureau said that e-commerce grew by 14.3% on both an unadjusted and adjusted basis in the quarter. The report also said that e-commerce accounted for 9.5% of US retail sales on an unadjusted basis that quarter and for 8.3% of retail sales on an adjusted basis. Thus, a solid 90.5% of US retail sales did not arise from e-commerce in the fourth quarter of 2016. If we look at the Census Bureau’s unadjusted figures for the year, they indicate that nearly $4.5 trillion of US retail sales (or nearly 92%) did not stem from e-commerce in 2016.

- Retailers are closing some, but not all, stores. Major retailers such as Macy’s and JCPenney have announced closures, and Payless ShoeSource’s recent bankruptcy filing will also result in store closures. In addition, Bloomberg reports that teen clothing retailer Rue21 is preparing to file for bankruptcy and iconic US retailer Sears said in an SEC filing that there was doubt that it could remain a going concern. Many industry leaders have commented about a bubble in US retail space: for example, the CEO of Urban Outfitters recently said that the US now has six times the amount of retail space per capita as Japan and Europe, and that this bubble is now bursting. Unfortunately, this correction in the amount of retail space and the number of stores in operation has negative consequences for retail employees. Nearly 30,000 retail jobs were eliminated in March, in addition to more than 60,000 since January.

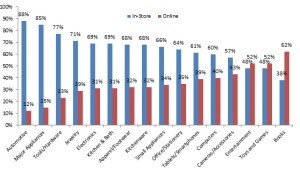

- Consumers still like to visit physical stores. In a recent survey of 1,200 shoppers conducted by Market Track, a majority of those polled said they still prefer to shop for most items (except entertainment, toys and games, and books) in a store, as the figure below illustrates.

Figure 1. Shopper Preferences for Buying Specific Categories In-Store or Online

Source: Market Track

Although the US retail industry is undergoing a painful correction and retailers will have to continue to adapt to increasing e-commerce penetration, store counts are likely to return to more sustainable levels in the future.

Other pieces you may find interesting include: Fashion Innovations, Our Top Takeaways from SXSW, Free Two-Day Shipping Is the New “Table Stakes” for E-Commerce, From Runway to Checkout, The See-Now-Buy-Now Trend in Fashion

Connect with us on social media:

@DebWeinswig

@FungRetailTech

Facebook

LinkedIn

Subscribe to our YouTube channel

Pinterest

Instagram