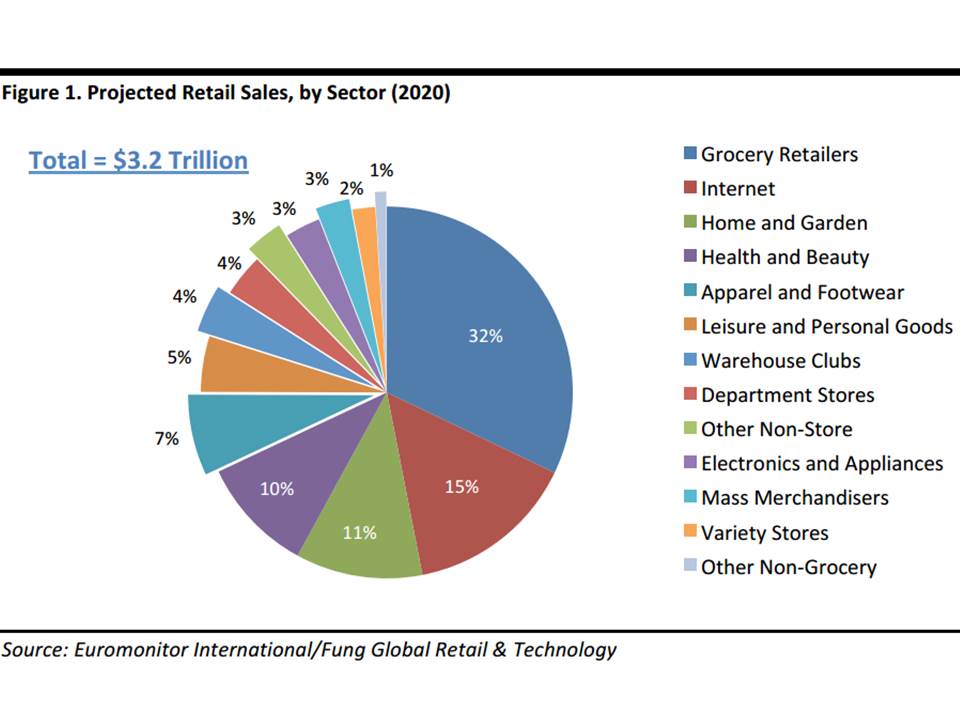

We recently attended a three-year planning meeting for Li & Fung, an affiliated company within the Fung Group, which got us thinking about how the retail industry will look in 2020. To gain insight, we looked at data from market research firm Euromonitor International, which, although fairly conservative, is quite valuable. According to Euromonitor, the US retail industry will report total sales of slightly more than $3.2 trillion in 2020, up from $3.0 trillion this year, for a 1.8% CAGR. For context, consider that the US Congressional Budget Office forecasts US annual GDP growth of 3.9%–4.0% over the 2016–2020 period, and that the National Retail Federation forecasts US retail sales growth of 3.1% in 2016.

Euromonitor’s 2020 retail sales estimates are shown in the figure above.

Euromonitor breaks retail sales into two major categories: store (which accounts for 82% of projected 2020 sales) and non-store (which accounts for 18%).

The largest store category is non-grocery specialists, which include (in order of decreasing size) home and garden, health and beauty, apparel and footwear, leisure and personal goods, electronics and appliances and other. Together, these are expected to represent nearly $1.2 trillion in sales and a CAGR of 0.5%. All of these categories except electronics and appliances and other are expected to grow during the 2016–2020 period (electronics and appliances and other are expected to decline). The apparel and footwear market is expected to total more than $275 billion in 2020, and to grow at a 0.7% CAGR from 2016–2020.

The second-largest store category and the largest category overall is grocery. The US retail grocery market is expected to exceed $1 trillion in 2020, growing at a 0.7% CAGR from 2016–2020; that figure roughly accords with the US Census Bureau’s projection of 0.8% annual population growth during those years.

The third category within stores, the mixed category, includes (in order of decreasing size) warehouse clubs, department stores, mass merchandisers and variety stores. Together, these stores’ sales are expected to total more than $400 billion in 2020, and to grow at a 0.6% CAGR. All of these categories are expected to grow except mass merchandisers, which is expected to post a modest decline.

The non-store category is dominated by Internet sales, which are expected to comprise 82% of this category and amount to more than $475 billion in 2020. Euromonitor expects Internet retail to grow at a 12.0% CAGR through 2020. By way of comparison, the US Census Bureau reported that year-over-year e-commerce growth in the fourth quarter of 2015 was 14.5%.

So, although these Euromonitor forecasts appear quite conservative, they are still extremely helpful in terms of understanding the US retail industry, and we look forward to analyzing these data in greater detail in the future.

See all of our weekly insights here.

Connect with us on social media:

@DebWeinswig

@FungRetailTech

Facebook

LinkedIn

Subscribe to our YouTube channel

Pinterest

Instagram